Futures Dynamic Grid is a staggered strategy on the futures market that dynamically adjusts its grid entries depending on volatility on the market. This strategy will place limit orders on price levels and will fill each executed order with its counterpart order. So if the buy order is filled the strategy will place the opposite sell order. This strategy is profitable if the actual price fluctuates inside your grid boundaries and your price change (price difference between 2 grid entries) is greater than fees you have to pay on the exchange.

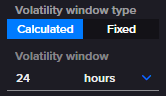

Futures Dynamic Grid recalculates grid entries (order prices) every time (as set in Volatility check time). It checks volatility on exchange (Calculated) or uses predefined volatility (Fixed) and replaces grid entries according to new volatility. Volatility defines how wide (in terms of price spread) the grid should be.

Calculated volatility

Difference of prices between maximal High and minimal Low price from OHLC data for period of defined Volatility window (eg. 24 hours).

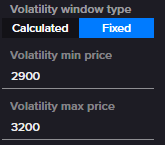

Fixed volatility

Difference of prices between Volatility max price and Volatility min price.

How to create bot

- Select Name of your bot

- Select Market

- Set quantity in base asset or quote asset – Quantity used to place grid limit orders. If quote asset quantity set, then it will be transformed to the base asset quantity. Strategy will use only base asset quantity for order placement.

- Set Max grid count – count of grid entries (price levels). Attention – 1 order is always (so called) unplaced order, so you will see only Grid count – 1 placed limit orders.

- Set Min price step [%] – minimal price step in % between 2 grid entries. If after volatility calculation the result is smaller than the Min price step for the next price level, the Min price step is used instead.

- Set Gap constant [%] – This number adjusts the volatility range. If set to 0% then volatility is the same as calculated/fixed, when set to >0% then the volatility range is wider than calculated/fixed. (eg. if Gap is set to 2% and calculated volatility range (difference of max high and lowest low price) is 1000 USD, then the range will be adjusted to 1020 USD)

- Set Check time in seconds – interval in that bot checks changes on exchange and replaces filled orders

Volatility settings

- Set Volatility check time – interval in that bot checks volatility and adjusts grid entries.

- Choose Volatility window type – Calculated / Fixed according to selected type select Volatility window or Volatility min/max price.

- Set Volatility protection [%] – You can set volatility protection to protect yourself from rapidly changing volatility between 2 volatility checks. If set to > 0% then after each volatility range calculation is a new volatility range compared to the old one and if the change is greater than specified Volatility protection, the bot is automatically stopped. Attention – limit orders are canceled, but opened (exposed) positions are not closed automatically.

- You can see a preview of the grid with actual settings in the chart.