Futures Dynamic Grid Pro is a staggered strategy on the futures market as Futures Dynamic Grid Bot but with advanced features.

PRO Features

- Different grid settings for different trends on market (Long, Short, Neutral), then as the situation changes on market, you can switch actual trend and your settings will be applied.

- Multiple take profit settings that can decrease or close entire position if in desired profit

- Stop loss setting to close losing position when the loss exceeds chosen value

- Asymmetric grid so that you can increase bid (buy) orders quantity if long position opened (exposed) and loss on the position is greater than specified criteria

- Trailing threshold so that your grid trails when price is going to move out of you grid boundaries

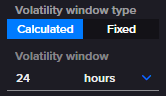

Calculated volatility

Difference of prices between maximal High and minimal Low price from OHLC data for period of defined Volatility window (eg. 24 hours).

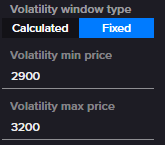

Fixed volatility

Difference of prices between Volatility max price and Volatility min price.

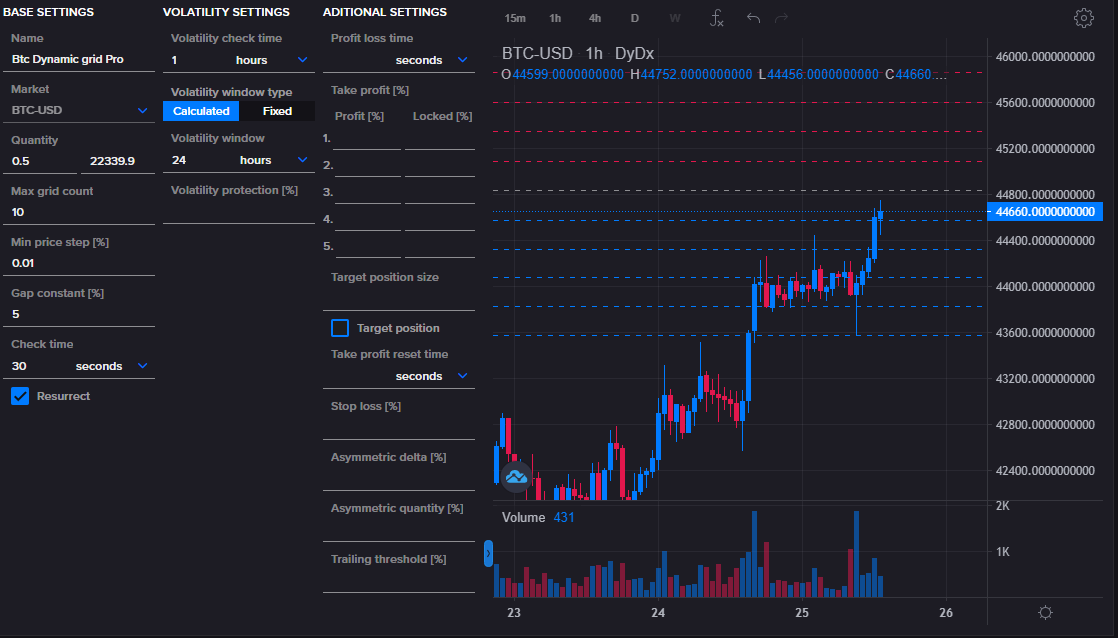

How to create bot

ow to create bot:

- Select Name of your bot

- Select Market

- Set quantity in base asset or quote asset – Quantity used to place grid limit orders. If quote asset quantity set, then it will be transformed to base asset quantity. Strategy will use only base asset quantity for order placement.

- Set Max grid count – count of grid entries (price levels). Attention – 1 order is always (so called) unplaced order, so you will see only Grid count – 1 placed limit orders.

- Set Min price step [%] – minimal price step in % between 2 grid entries. If after volatility calculation the result is smaller than Min price step for next price level, the Min price step is used instead.

- Set Gap constant [%] – This number adjusts volatility range. If set to 0% then volatility is the same as calculated/fixed, when set to >0% then volatility range is wider than calculated/fixed. (eg. if Gap is set to 2% and calculated volatility range (difference of max high and lowest low price) is 1000 USD, then the range will be adjusted to 1020 USD)

- Set Check time in seconds – interval in that bot checks changes on exchange and replaces filled orders

Volatility settings

- Set Volatility check time – interval in that bot checks volatility and adjusts grid entries.

- Choose Volatility window type – Calculated / Fixed according to selected type select Volatility window or Volatility min/max price.

- Set Volatility protection [%] – You can set volatility protection to protect yourself from rapidly changing volatility between 2 volatility checks. If set to > 0% then after each volatility range calculation is a new volatility range compared to the old one and if the change is greater than specified Volatility protection, the bot is automatically stopped. Attention – limit orders are canceled, but opened (exposed) positions are not closed automatically.

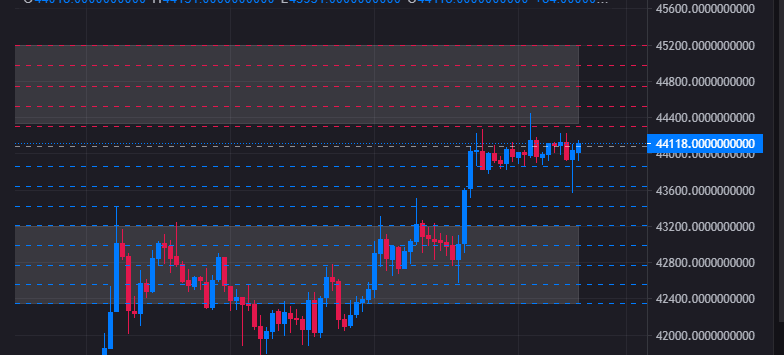

- You can see a preview of the grid with actual settings in the chart.

Additional Settings

- Profit loss time – interval in that bot checks if additional settings should apply (take profit, stop loss, trailing)

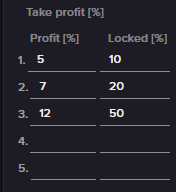

- Take profit – Set in % when (Profit [%]) and how much (Locked[%]) of profit should be locked. You can set multiple values. Each level that was realized will be marked as executed.

You can view take profit preview in the chart.

- Target position size – additionally you can set your target position size on exchange, so if your position is bigger and in profit, then bot will realize this profit to lower your position size to the Target position size.

- Target position – should be checked if you want the Target position size setting to be applied.

- Take profit reset time – When some of the Take profit levels were hit and realized this timer resets the execution flag on them.

- Stop loss – If you want to use stop loss feature, set (in % of position loss) when your position should be closed.

- Set Asymmetric delta [%] – asymmetric grid will be activated when loss % on opened long position is greater than Asymmetric delta.

- Set Asymmetric quantity [%] – how the quantity of bid (buy) orders should be adjusted (increased by Asymmetric quantity %).

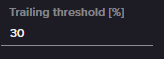

- Trailing threshold – Threshold when the grid should trail (move). Threshold is calculated from the upper and lower boundary price of the grid.

You can see the preview of threshold setting in the chart.